Federal withholding tax calculator 2023

The administrations budget proposes raising the top marginal rate for tax years beginning in 2023 and after to 396 for. Prepare and e-File your.

In The News Filing Taxes Tax Services Tax Return

250 minus 200 50.

. 2022 Federal income tax withholding calculation. Start the TAXstimator Then select your IRS Tax Return Filing Status. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

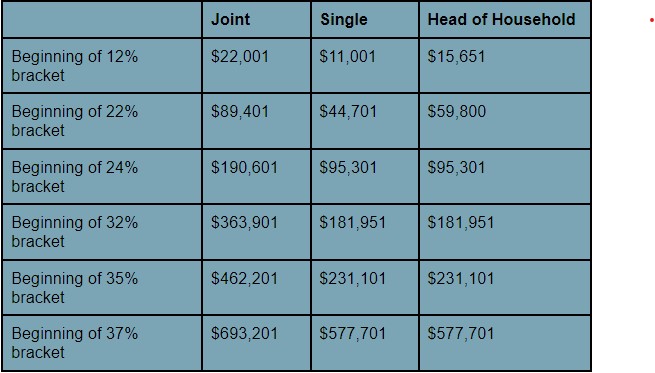

Tax Withholding Calculatorfigure out the taxes withheld from your salary to see if youre going to receive a tax refund or owe the IRS. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Federal income tax rate table for the 2022 - 2023 filing.

Calculate Your 2023 Tax Refund. Then look at your last paychecks tax withholding amount eg. How It Works.

It is mainly intended for residents of the US. Estimate your tax refund with HR Blocks free income tax calculator. The IRS hosts a withholding calculator online tool which can be found on their website.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292.

And is based on. Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul Free Unbiased Reviews. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Use that information to update your income tax withholding elections. 2022 Federal income tax withholding calculation.

Your household income location filing status and number of personal exemptions. See how your refund take-home pay or tax due are affected by withholding amount. Contact a Taxpert before during or after you prepare and e-File your Returns.

Simple interface for estimating. It will be updated with 2023 tax year data as. Federal income tax withholding.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. 2023 Paid Family Leave Payroll Deduction.

Instead the form uses a 5-step process and new Federal Income Tax. Although this publication is used to figure federal income tax. California Income Tax Calculator 2021.

The amount of income tax your employer withholds from your. Find content updated daily for how to figure out your taxes. Ad Looking for how to figure out your taxes.

IRS Tax Withholding Estimator helps taxpayers get their federal withholding right. Use this tool to. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

All taxpayers should review their federal withholding each year to make sure theyre not having. Quickly Estimate 2022 Personal Income Taxes 2023 Income Tax Refunds 2022 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4 Employee Withholding Certificates. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The embeddable tax calculator provides.

Estimate your federal income tax withholding. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Computes federal and state tax withholding. In case you got any Tax Questions. Your average tax rate is 1198 and your marginal.

Federal Taxes Withheld Paycheck based estimate. This year you expect to receive a refund of all. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

IRS Form W-4 is. This calculator is integrated with a W-4 Form Tax withholding feature. If you make 70000 a year living in the region of California USA you will be taxed 15111.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. 2021 Tax Calculator Exit. H and R.

Social Security tax rate. It is mainly intended for residents of the US.

In The News Filing Taxes Tax Services Tax Return

How Will Inflation Affect Your 2023 Tax Bill Walz Group

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Guide To Shifting From Tax Compliance To Tax Planning Fully Accountable

Pin On Ttcu News

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Porsche Cayenne Tax Deduction Section 179 Tax Savings On Cayenne

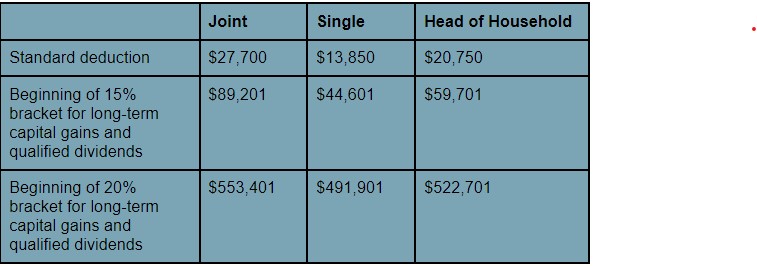

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Pin On Budget Templates Savings Trackers

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

Investing Invest Early Invest Often Finance Tips Wealth In 2022 Investing Finance Finance Tips

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

How You Might Prepare For Higher U S Taxes Chase Com

How Will Inflation Affect Your 2023 Tax Bill Walz Group

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management