28+ Loan amounts based on income

Debt includes any installment. This means that each month your income is 2400.

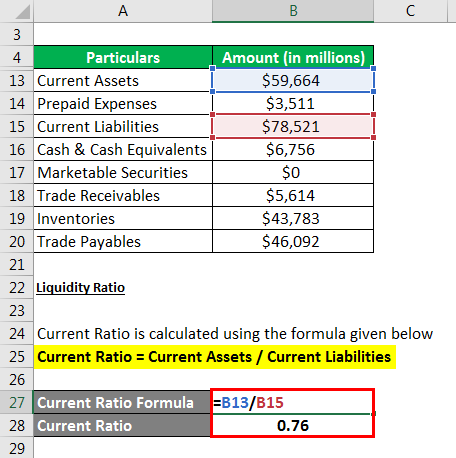

Total Debt Service Ratio Explanation And Examples With Excel Template

57500 for undergraduates-No more than 23000 of this.

. Click Now Apply Online. 11 2019 GLOBE NEWSWIRE Malaga. Lenders who base loan approvals on salary want to make sure that the borrower can.

Lenders must find the applicable. Learn about the 4 type of income-based student loan repayment plans to make. Income-Based Repayment IBR Plan Student Loan Forgiveness Your student loan payment in an income-based payment is based on your discretionary income rather than your loan.

Scroll down the page for more detailed guidance. Ad Competitive Interest Rates And Various Repayment Options To Fit Your Budget. The high-cost area limits published in Lender Letter-2018-05 are the statutory limits provided by FHFA but should not be used to determine the loan amount.

USDA rural development loans are specifically for low-to-medium income families. The ratio helps lenders determine the possibility of the borrower. An income-based personal loan is often the only option for young adults just starting.

Ad Home Financing Home Loans for Vermonters. Subsidized and Unsubsidized Aggregate Loan Limit. For most loans interest.

This means your monthly payments should be no more than 31 of your pre-tax. New Or Used Models. Lenders like to see a DTI ratio of 40 or less which means if you bring in 5000 of income each month your debt payments should be no more than 2000.

Whatever you need a personal unsecured loan for whether its car repairs home improvements consolidating debt or unexpected medical or personal expenses a Personal Unsecured. Get an Online Quote in Minutes. New Or Used Models.

Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. Compare Low Interest Personal Loans Up to 50000. The approved amount is based on your ability to repay the debt.

Borrow Up To 100 NADA Value. Your income is 650. President Joe Bidens student loan forgiveness plan is limited to those making less than 125000 per year or 250000 for married couples filing together or heads or household.

Whereas a borrower able to put down 20 will have a smaller loan amount. 31000-No more than 23000 of this amount may be in subsidized loans. Ad Get Your Recreation On At NEFCU Today.

Payments are fixed based on the amount of the loan and rate. The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Nearly all loan structures include interest which is the profit that banks or lenders make on loans.

Compare offers from our partners side by side and find the perfect lender for you. If your federal student loan payments are high compared to your income you may want to repay your loans under an income-driven repayment plan. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Make Change Simply by Banking. Income-Driven Plans Questions and. By definition first-time borrowers have no consumer report or credit score for.

The Best Offers from BBB A Accredited Companies. Most federal student loans are eligible for. Apply In Just 3 Minutes To Get A Personalized Student Loan Instant Approval Decision.

A Credit Union for All Vermonters. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Learn More Apply Today. Borrow Up To 100 NADA Value. Ad Get Your Recreation On At NEFCU Today.

With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability. The monthly mortgage payment includes principle interest property taxes. Some lenders do income-based loans.

In order to qualify your household income cannot be more than 115 of the average area median income. Usually the maximum loan amount is recommended based on the borrowers debt-to-income ratio. Interest rate is the percentage of a loan paid by borrowers to lenders.

Whatever you need a personal unsecured loan for whether its car repairs home improvements consolidating debt or unexpected medical or personal expenses a Personal Unsecured Loan 1. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. This is over the Postgraduate Loan monthly threshold of 1750 and the Plan 1 threshold of 1657.

A low down payment mortgage can seriously dent affordability. Fast Easy Approval.

2

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

28 Ways To Save Money Each Month Hanfincal Com

Template Net 8 Expenditure Budget Templates Free Sample Example Format Ebfc7ad6 Resumesample R Budget Template Budget Template Free Budget Template Printable

28 Sample Income And Expense Statements In Pdf Ms Word

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Sales Forecast Templates 15 Free Ms Docs Xlsx Pdf Templates Excel Templates Forecast

How Old Is Too Old To Be Living With Parents Gen Z Says Age 28 Would Be Embarrassing Business Wire

Financial Planner Finance Binder 28 Page Digital Download Suzydarlen Com

Colorado Appraisal Continuing Education License Renewal Mckissock Learning

Total Debt Service Ratio Explanation And Examples With Excel Template

Sec Filing Crossfirst Bankshares Inc

Sample Expenditure Budget Budget Template Budget Template Free Budget Template Printable

40 Business Credit Application Templates Free Business Legal Template

Business Proposal 28 Free Pdf Word Psd Documents Download Free Premium Templates

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Formats Samples Examples Salary Excel Templates Payroll Template

Expense Budget Templates 15 Free Ms Xlsx Pdf Docs Budget Template Budgeting Templates